What Is Secondary Insurance and Do You Need It

It can be tricky planning for the unforeseen future—that’s why we have health insurance, but what happens when your primary plan runs thin?

Secondary insurance might be your best bet against unforeseen events—when combined with your primary plan—you and your family can feel more secure.

But owning multiple insurance plans can be costly, so is it worth it?

Read on to discover the benefits of obtaining secondary health insurance, and how having two insurances may be a cost-effective option against future health challenges life may throw your way.

Secondary Insurance Definition

A secondary health insurance plan is an additional coverage bought separately, such as accident insurance that helps cover any shortcomings of your primary insurance plan.

It works in conjunction with any existing primary insurance without nullifying your coordination of benefits. The plan also covers things that your primary insurance may not such as dental, vision, and disability coverage, just to name a few.

Some secondary insurance plans may provide cash benefits allowing full coverage of any unprecedented out-of-pocket healthcare costs that may arise when sick or gravely injured.

Primary vs Secondary Insurance

While both insurance plans share similar coordinated perks, they both consist of two separate frameworks affecting how well providers cover a patient.

Use

Primary Health Insurance: After seeking treatment, your health care provider will bill your medical estimate. Your primary health insurance plan kicks in first paying any incurred medical costs and fees associated with your health coverage plan until you reach your account limits.

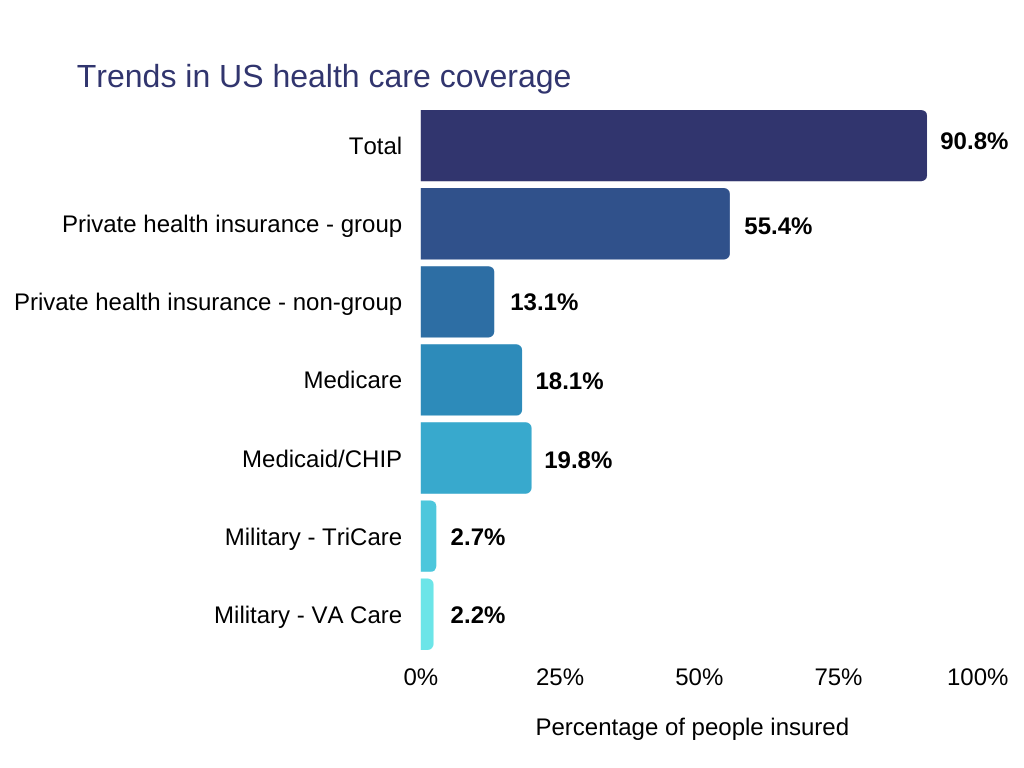

Approximately 90.8% of US citizens have some kind of primary health care coverage

Once you exceed, you’ll be required to pay out of pocket thus limiting your financial flexibility.

Secondary Health Insurance: Secondary insurance takes effect after your primary health insurance plan has run thin. If you owe any additional expenses such as medical procedures and prescription costs, your secondary health insurance provider will take care of the remaining bill for you.

Eligibility

Primary Health Insurance: Usually covers employees and insurance plan members over the age of 18 with a valid id card. Children may also be eligible for primary insurance under their parent’s job-based or private plan.

Secondary Health Insurance: Requirements tend to be pickier than what primary insurance companies look for. You can qualify for secondary insurance if you fall within the following categories:

- You’re either an adult under the age of 26 who is married, pregnant, or on their parents’ primary plan [1].

- You have an id card or are an adult under 26 signed under an employer plan or life insurance.

- Veterans who have obtained veterans administration (VA) benefits for their service and have a functioning primary health plan [2].

- Seniors under Medicare and private insurance.

Coverage

Primary Health Insurance: Prioritizes any impending health care costs and medical bills until an individual’s amount limit is exhausted. Most stick to fundamental cover like medical care but exclude hospital stay, prescriptions, and other minor services.

Secondary Health Insurance: Caters to remaining deductibles, coinsurances, and copays. It can also help to cut costs when the primary insurance denies coverage for certain services.

What Is the Difference Between Secondary and Supplemental Insurance?

Supplemental insurance provides additional coverage only after your primary health insurance plan finishes paying your claim. On the other hand, secondary health policy focuses on providing people with full health care coverage and is a separate standalone policy.

Unlike secondary insurance, supplemental is not a standalone plan but functions in coordination with your current health insurance plan. It also features lesser coverage than the typical amount of both primary and secondary policies.

How Does Secondary Insurance Work?

Secondary health policies work hand in hand with an existing health policy covering any unresolved medical or service costs incurred during treatment or medical examinations.

To understand the role and functionality of a secondary health plan here is a breakdown of each insurance policy:

- Lump-sum policy plans: Secondary health policies may pay a cash amount if you suffer an injury or sickness. You’re free to spend the money however you want like paying off deductibles, medical bills, or even household expenses and childcare.

- Supplemental health policy plans: Covers services and products not provided by primary insurance companies such as copays, coinsurances, and deductible options. When your account falls under the deductible range, the plan kicks in to split the costs of your bill. However, you will be required to settle a copayment the next time you visit your provider.

- Gap insurance plans policy: This secondary plan works by covering any out-of-pocket healthcare expenses like high medical plan deductibles should you need it [4]. You can also use gap insurance to cover a vision or dental plan deductible without breaking the bank.

Most health insurance policies require a monthly premium depending on the exact type and coverage. If you’d like to keep costs low, there are excellent cheap health insurance companies available or you might choose to get short term health insurance.

What Does Secondary Insurance Cover?

Most secondary insurance companies cover medical costs such as lab fees, prescriptions, x-rays, medical examinations, treatment, and hospital services.

The full range of coverage depends on the plan you wish to buy so be cautious when settling for secondary health cover. Most plans don’t cover services and treatment of cosmetic or experimental purposes.

Below are some common plans covered by secondary health insurance.

Dental

Dental plans provide patients with preventative care for their oral health. It caters to routine teeth cleaning, some x-rays, and checkups. Some also provide access to extensive specialized dental care, so be sure to get more information on available dental plans before sticking to a specific one.

Vision

A vision plan can be the best way for children and adults to access affordable vision care benefits catering to routine eye exams, or the cost of obtaining contacts and glasses.

Disability

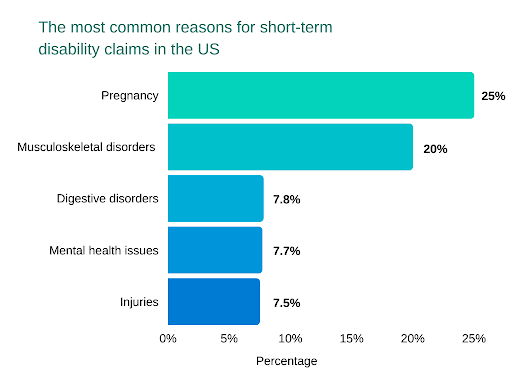

Secondary coverage deals with both short and long-term disability. Disability plans are useful when a patient falls sick, gets injured, or experiences temporary impairment preventing them from working and earning their income.

Hospital

This cover provides access to optimal hospital care in the event you get sick and require a hospital stay. Some plans may cover severe illnesses such as heart attack while others may deposit a cash payment for your hospital charges.

What Does Secondary Insurance Cost?

The cost of secondary insurance plans such as Medicare or Medicaid will vary depending on several important factors such as:

- Guaranteed issue rights

- Plan type

- Plan rating systems

- Individual or family enrolment including parents, children, or spouse.

The bare estimate of Medicare secondary insurance costs anywhere from $70 to $300 for a monthly premium, with Medicaid costing 22% less than private insurance making it ideal for low-income employees [5].

Policies with higher premiums will have fewer deductibles whereas low premiums tend to have high deductibles, so pick wisely when choosing a health or life insurance plan.

How Is Secondary Insurance Billed?

Coordination of benefits determines which health plan provider gets billed and prevents duplicate billings. Your secondary plan is usually billed last after a remaining balance is left to settle. After your insurance provider remits your claim, you can submit a new one for your secondary insurance to settle after claim approval.

Is It Worth Having Secondary Health Insurance?

Consider asking yourself the following questions to determine if an additional health plan is best for you.

- Do you feel unprotected by your current primary coverage?

- Do dental and vision care services appeal to you?

- Are you currently on a high-deductible medical plan?

- Are you physically active or have a history of chronic medical conditions/ injuries?

- Do you have poor vision and regularly go for eye tests and require prescription eyewear?

Through these questions, you can determine if secondary coverage may be ideal for your current situation. If you need more help figuring out your options, read more information about each plan’s coordination of benefits and privacy policies of the best health insurance companies.

Pros and Cons of Multiple Health Insurance Plans

Being eligible under two health plans increases the amount of coverage people can get. Through coordination of benefits, multiple plans may work in conjunction to provide patients with seamless cover for any additional medical payments without out-of-pocket expenses.

But in some cases, you may be better off sticking to one distinct policy plan rather than two. Here are the pros and cons of choosing two health plans to help you decide which path to choose.

Pros

- You’ll receive more coverage than sticking to a single plan.

- Provides a safeguard even if you lose your job or forfeit employer coverage.

- You may remain covered under your spouse’s or parents’ health insurance policy with little to no expense incurred on their end.

- When one plan lets you down, the other will cover costs such as services and medical products when your primary health policy doesn’t.

- If health care providers charge more than what your primary cover can handle, the balance is cleared by your supplemental insurance provided it’s within your account limit.

Cons

- Having multiple health insurance plans doesn’t exempt you from out-of-pocket expenses.

- You’ll still have to pay deductibles and premium fees for both plans instead of one.

- Coordination of benefits provided by two different insurance companies may be incompatible.

- You still would abide by plan rules. For example, your secondary health plan will not remit any price quote when using an out-of-network provider that is not covered under your primary health plan [6].

- Multiple health plans only cover reasonable and customary amounts, so there’s no guarantee you’ll be covered fully when surcharged for medical services or supplies.

FAQ

Understanding the full extent of secondary health insurance policies can be puzzling. If you have any inquiries, here are a few commonly asked questions to help shed insight into any doubts you may have.

Should I Have Secondary Health Insurance?

While you’re not expected to secure a secondary health plan by law, it can be a useful addition to your health especially if you’re under your parents’ or employers’ health plan.

The extra protection and perks can be effective for employees or adults in emergencies or minor situations such as eye examinations, dental check-ups, or prescription billing. Ensure that you’re able to cover each monthly payment by obtaining a price quote and budget accordingly to prevent financial strain.

Where Can You Buy Secondary Insurance?

After you purchase a private medical plan via the Health Insurance Marketplace you can buy a secondary health insurance coverage of your preference [7].

You can also buy and add multiple secondary or supplemental insurance policies when signing under an employer plan during enrollment. If both options are unavailable to you, consider purchasing a secondary plan directly from private insurance businesses within your state.

Will Secondary Insurance Pay if Primary Does Not?

If your primary health policy denies your claim, there’s a chance that your secondary plan may cover a portion of the health insurance claim or choose not to pay at all. This can only be determined by the coordination of benefits between the two policies so be sure to gather information on all available choices before settling on one or more health plans.

Can You Have Two Health Insurance Plans at the Same Time?

Yes, you can have a primary health policy and receive aid from additional plans like Medicaid, Medicare, and other plan types simultaneously. To gain access to multiple health plans you should first obtain a primary policy though:

- The health insurance marketplace

- An employer plan

- Your parents’ plan

- Private insurance companies.

Certain situations like ongoing medical attention may require the aid of a secondary insurance provider to ease the financial stress of paying for medical services and products.

You can obtain more information on available coverage types and policies by visiting health coverage providers’ websites within your state.

Conclusion

Preparing for an unforeseen medical crisis can be difficult but with life insurance, you can easily cushion the financial blowback during an emergency. While having two health plans may be fruitful, it does come with disadvantages, such as additional costs.

Consider your short vs long-term health care goals and plan accordingly to help set you and your family on the right track to enjoying unhinged medical coverage.

References:

- “Health Insurance Coverage For Children and Young Adults Under 26.” HealthCare.gov, www.healthcare.gov/young-adults/children-under-26/.

- Redirect to Benefits Home Page, www.benefits.va.gov/.

- “Medicare Costs at a Glance.” Medicare.gov the Official US Government Site for Medicare, www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance.

- Sable-Smith, Bram. “Would You Like Some Insurance With Your Insurance?” NPR, NPR, 13 Sept. 2016, www.npr.org/sections/health-shots/2016/09/13/493695824/would-you-like-some-insurance-with-your-insurance.

- Published: May 03, 2013. “What Difference Does Medicaid Make? Assessing Cost Effectiveness, Access, and Financial Protection under Medicaid for Low-Income Adults.” KFF, 13 May 2013, www.kff.org/medicaid/issue-brief/what-difference-does-medicaid-make-assessing-cost-effectiveness-access-and-financial-protection-under-medicaid-for-low-income-adults/.

- “Type of Plan and Provider Network.” HealthCare.gov, www.healthcare.gov/choose-a-plan/plan-types/.

(DCD), Digital Communications Division. “What Is the Health Insurance Marketplace?” HHS.gov, 4 Aug. 2017, www.hhs.gov/answers/affordable-care-act/what-is-the-health-insurance-marketplace/index.html.

Understanding the intricacies of secondary insurance can be a complex endeavor, especially when considering how it complements your primary health coverage. Secondary insurance serves as an additional layer of financial protection, covering costs that your primary insurance may not, such as deductibles, copayments, and services outside of your primary plan’s network.

This type of insurance can be particularly beneficial in managing unforeseen medical expenses, providing broader coverage for dental, vision, and disability needs that are not typically included in primary health plans.

For individuals and families looking to maximize their health coverage while minimizing out-of-pocket expenses, secondary insurance offers a strategic way to enhance overall financial security against health-related uncertainties.

To navigate the complexities of secondary insurance and make informed decisions about your health coverage options, consulting with Legal.com’s staff experienced in all types of legal topics can provide valuable insights and guidance, ensuring that you and your loved ones are adequately protected.